Mortgage Rates Improve!

As usual, Jim provides a great overview of factors impacting home interest rates and reports on lastest sales data that I typically may have shared but is in context of the data shared here.

You will note that there is a "battle" between factors that improve interest rates and those that hurt interest rates. On the hurt interest rate side, strengthening inflation and improved job market. On the improve interest rates, poor retail sales and money flowing from stocks to bonds, including mortgage bonds!

Yet this comment is the most important to home buyers and home sellers:

The bottom line is that now remains a great time to consider a home purchase or refinance. Home loan rates remain attractive compared to historical levels, and they're at some of the best levels seen this year.

So though all the prognasticators expect interest rates to be 5.7% or so by end of 2015 thorough a gradual increase over time, this hasn't been shown to be true yet.

Yet you can't assume, with reasonable safety, that rates won't start to climb! Thus, it truly is a great time to purchase a home or to refinance/sell a home.

The window could be closing!

|

|

Provided to you Exclusively by Jim Belote

|

For the week of May 19, 2014 | Vol. 12, Issue 20

|

|

|

|

|

582 Lynnhaven Parkway, Suite 300

Virginia Beach, VA 23452

|

|

In This Issue... In This Issue...

|

|

|

|

Last Week in Review: Home loan rates hit some of their best levels of the year as a broad range of economic reports were released.

Forecast for the Week: Look for important housing numbers at the end of the week. Plus, volatility could be ahead thanks to the Fed minutes and low trading volume.

View: If you're traveling for business or pleasure soon, you'll want to read the important tips about online reviews below.

|

|

Last Week in Review Last Week in Review

|

|

|

|

This just in! Key news hit the wires almost every day last week, with important reports spread throughout the week. Plus, home loan rates reached some of their best levels this year. Here are the highlights you need to know about.

Over in the housing sector, April Housing Starts jumped 13.2 percent from March to an annual rate of 1.07 million units. This was above expectations and the highest level since November. The unexpected surge was led by multi-family dwellings or apartments, while single-family construction barely budged. Building Permits, a sign of future construction, rose by 8 percent to 1.08 million units, with apartment buildings leading the surge here as well. The takeaway is that builders are betting on the future expansion of renters. Over in the housing sector, April Housing Starts jumped 13.2 percent from March to an annual rate of 1.07 million units. This was above expectations and the highest level since November. The unexpected surge was led by multi-family dwellings or apartments, while single-family construction barely budged. Building Permits, a sign of future construction, rose by 8 percent to 1.08 million units, with apartment buildings leading the surge here as well. The takeaway is that builders are betting on the future expansion of renters.

However, it's also important to note that the price appreciation rate for homes has slowed and is expected to slow even further. Case Shiller confirmed that home prices rose 11.3 percent in 2013, but they see less than a 6 percent increase for 2014. With home loan rates near some of their best levels of the year, this is a key point to note for potential buyers and refinancers.

In other news, weekly Initial Jobless Claims fell to their lowest level since May 2007, while Retail Sales for April came in below expectations. While the spring thaw has seemed to help the labor market, it wasn't a boon for retailers last month. And after months of tame reports, inflation is starting to heat up at both the consumer and wholesale levels. Remember, inflation is the arch enemy of Bonds, as inflation reduces the value of fixed investments like Bonds. This includes Mortgage Bonds, the type of Bond on which home loan rates are based. While inflation numbers are still within the Fed's comfort zone, you can bet the Fed will be watching for a trend higher.

The bottom line is that now remains a great time to consider a home purchase or refinance. Home loan rates remain attractive compared to historical levels, and they're at some of the best levels seen this year. Let me know if I can answer any questions at all for you or your clients.

|

|

Forecast for the Week Forecast for the Week

|

|

|

|

With little economic data on the calendar and trading volumes decreasing toward the end of the week ahead of the Memorial Day holiday, we could have a volatile week ahead.

- Economic reports begin on Thursday with weekly Initial Jobless Claims. Last week's numbers hit seven-year lows.

- Look for two key housing reports at the end of the week: Existing Home Sales on Thursday and New Home Sales on Friday.

In addition, the minutes from the April 29-30 Federal Open Market Committee meeting will be released on Wednesday at 2:00 p.m. EDT. The minutes could offer even more volatility, especially if they reveal additional details regarding tapering of the Fed's massive Bond buying program.

The Bond markets will be closing at 2:00 p.m. EDT on Friday and all U.S. markets will be closed the following Monday in observance of Memorial Day.

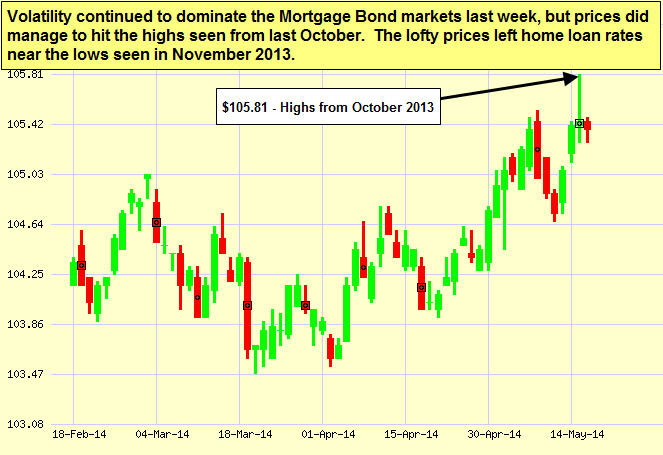

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond on which home loan rates are based.

When you see these Bond prices moving higher, it means home loan rates are improving—and when they are moving lower, home loan rates are getting worse.

To go one step further—a red "candle" means that MBS worsened during the day, while a green "candle" means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning.

As you can see in the chart below, Bonds and home loan rates reached some of their best levels in recent months. With a potentially volatile week ahead, I'll be watching the markets closely.

Chart: Fannie Mae 4.0% Mortgage Bond (Friday May 16, 2014)

|

|

The Mortgage Market Guide View...

|

|

|

|

|

Weigh Online Travel Reviews Carefully

Compare opinions on several sites, and don't neglect word of mouth.

By Miriam Cross, Kiplinger.com

Before dropping a few hundred dollars on a fancy hotel room with rave online reviews, be sure that what you're reading is legitimate, and not the work of a hired writer or the business itself. As online review platforms such as Yelp and TripAdvisor become more popular, businesses have a greater incentive to game the system—drumming up buzz with planted accolades or tarnishing competitors with unfair criticism. Last year the New York state attorney general's office cracked down on 19 companies that solicited fake reviews to prop up local services.

The problem has not gone unnoticed by review sites. Yelp filters out 25% of submissions. Some sites require the reviewer to have made a reservation for a hotel room or restaurant through the site before detailing his or her experiences; other sites highlight contributors with authenticated profiles or alert consumers to suspicious content.

But no site has a foolproof system, so it's important to cross-reference write-ups for the same establishment on different sites. The breadth of reviews on free sites should provide enough accurate information. If you're looking for a specialized service, scrutinize the reviewer, not just the review. A full profile, a history of contributing to the site and a "verified user" tag are good signs. And don't neglect word of mouth. "Asking people you know and trust is the first thing you should do before trusting strangers online," says Boston University professor Georgios Zervas, who studied fraudulent Yelp reviews.

If you're the one penning a negative assessment, avoid becoming the target of legal threats by sticking to indisputable facts, toning down hyperbole and emphasizing that this is your experience.

Reprinted with permission. All Contents ©2014 The Kiplinger Washington Editors. Kiplinger.com. Reprinted with permission. All Contents ©2014 The Kiplinger Washington Editors. Kiplinger.com.

Economic Calendar for the Week of May 19 - May 23

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

Wed. May 21

|

02:00

|

FOMC Minutes

|

4/30

|

NA

|

|

NA

|

HIGH

|

Thu. May 22

|

08:30

|

Jobless Claims (Initial)

|

5/17

|

305K

|

|

297K

|

Moderate

|

Thu. May 22

|

10:00

|

Existing Home Sales

|

Apr

|

4.66M

|

|

4.59M

|

Moderate

|

Fri. May 23

|

10:00

|

New Home Sales

|

Apr

|

415K

|

|

384K

|

Moderate

|

|

|

|

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

If you prefer to send your removal request by mail the address is:

Jim Belote

Union Mortgage Group

582 Lynnhaven Parkway, Suite 300

Virginia Beach, VA 23452

Vantage Production, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Vantage Production, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

|

|

No comments:

Post a Comment