Only more support to the every growing crescendo noting an improving housing market.

We can't help but shout it as Realtors!

Off the Fence!!!

The Virginian-Pilot

©

Michelle Muglia’s trio of Chesapeake-basedconstruction companies employed 90 workers at the height of the housing boom, but by the time the dust settled after the Great Recession, all but 36 were out of a job.

“It was really the ugliest time in our lives,” said Muglia, who co-founded drywall, painting andflooring companies with Rob LeBlond about 15 years ago. “My partner and I had to bring great people in and say, ‘I’m sorry, but we have to reduce overhead.’ ”

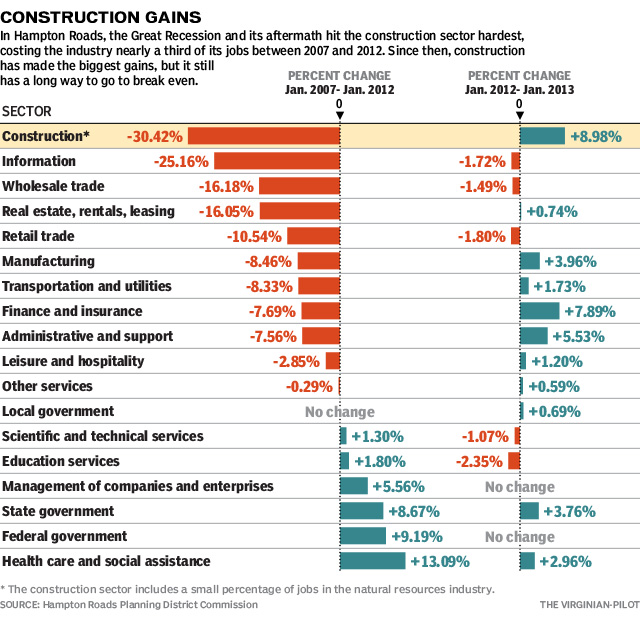

Construction was the hardest-hit employment sector in Hampton Roads between January 2007 and January 2012, losing 14,600 of its 48,000 jobs – 30 percent – according to data from the Hampton Roads Planning District Commission.

By January 2013, the industry had regained 3,000 jobs and was leading job growth locally with a nearly 9 percent boost over January 2012.

But a long road lies ahead as construction companies limp out of a rut. Many are still feeling squeezed by a contracted economy and the uncertainty over looming defense cuts.

Muglia said she’s not surprised to see data pointing to a turnaround in her industry.

She and LeBlond were able to hire back some of the employees they laid off after the housing bust. Collectively, Tidewater Interior Wall & Ceiling Inc., Mid-Atlantic Painting Inc. and Rated Floor Systems of Virginia LLC now employ 55 workers, 19 more than when the businesses bottomed out.

“Last year, our sales were just on fire,” Muglia said. “Literally, it was like the banks released money on the same day, because all of a sudden,the jobs started again.”

Apartment complex construction and renovation have generated most of the contracts in the past year, Muglia said.

Revenue at the peak was around $18 million for the three companies, she said. That dropped to less than $10 million after the bust, but it climbed back to a little over $16 million in 2012.

If Muglia could charge 2006 or 2007 rates for work, revenue would have topped $20 million last year, but owners of several construction companies said they had to slash prices to stay in business.

Mark Worton, owner of Landstar Paving in Chesapeake, said many of his former cohorts sold their equipment and found work in other industries.

Landstar specializes in repairing parking lots and driveways. The pace of business has been relatively level, Worton said, but his profits have been ravaged by high gas prices.

He used to employ six part-time workers, but that’s dropped to two or three. He doesn’t expect to be able to hire anytime soon.

“That makes me get out and do all the work,” Worton said. “I didn’t have to do that in the past. … But I feel like I’m succeeding because I’m still in business.”

Kenneth Carpenter, a Suffolk-based land surveyor who works mainly in new-home construction, feels the same way. He used to have a crew of five or six workers, but now he and his wife are on their own.

In 1999, his company, Kenneth R. Carpenter Land Surveyor PC, landed 272 new contracts. Work dipped significantly in 2002 but had inched back up to 108 contracts by 2007.

Then the bottom fell out and homebuilding nearly ground to a halt. Carpenter had 49 new contracts in 2008, 31 in 2010 and 23 in 2012.

“Things just seem like they’re the next thing to dead,” he said. “They’re just not moving.”

Carpenter wonders whether he was aggressive enough in going after business, but he knows anecdotally that his fellow surveyors have suffered, too.

Greg Grootendorst, chief economist for the Planning District Commission, said it’s not clear from data which specialties in the construction industry are rebounding and which are still struggling, but that the sector is no longer a drag on the local economy.

If growth continued at the 2012 pace for the next four years, employment might return to pre-recession levels, Grootendorst said. But military cuts resulting from sequestration have dampened expectations. Nearly half of the local economy is dependent on defense spending.

“We have, in the region, a lot of making up to do with respect to employment,” Grootendorst said. “Ideally, what we’d like to see is every industry headed toward recovery, but, unfortunately, that’s not what we’re realizing at this point.”

Total nonfarm employment in Hampton Roads dropped 5.2 percent between January 2007 and January 2011. But since then, it has grown 2.6 percent, to 737,200 jobs.

In a Planning District Commission breakdown of 32 local employment sectors, construction was among eight that had fewer employees in 2012 than in 1990.

Nationally, construction employment grew from September through February, but it held steady in March, according to an employment study of seasonally adjusted private sector jobs published recently by ADP. Local figures for March are not yet available from the U.S. Bureau of Labor Statistics.

Homebuilder Ben Braddock, who owns Norfolk-based Rock Creek Development, said his company went from building eight to 10 homes a year during the heyday to two to three homes a year.

Business is still slow, and he doubts it will return to pre-recession levels because young adults are tending to rent rather than buy new homes.

“There’s a whole lot of new apartments, and the rental market in Hampton Roads is doing well because there’s a whole lot more folks out there that are going to be renting for a while because either they got burned by their first home or they got stuck in their first home,” Braddock said.

Clancy and Theys, a national construction company with an office in Newport News, has benefited from the apartment boom. Thomas O’Grady, director of business development for the Virginia division of the company, said multifamily construction has been the strongest sector of commercial construction.

But Clancy and Theys has a pipeline full of jobs in higher education, health care and government work, O’Grady said.

This year, the company is far more optimistic about the future, but there are still uncertainties, he said.

“I’m not sure we’ll ever go back to those go-go years,” O’Grady said.

Sarah Kleiner Varble, 757-446-2318, sarah.varble@pilotonline.com

No comments:

Post a Comment